27+ Annual Lease Value Table 2021

IT RETAINS THE ANNUAL. The daily lease value is calculated by multiplying the applicable.

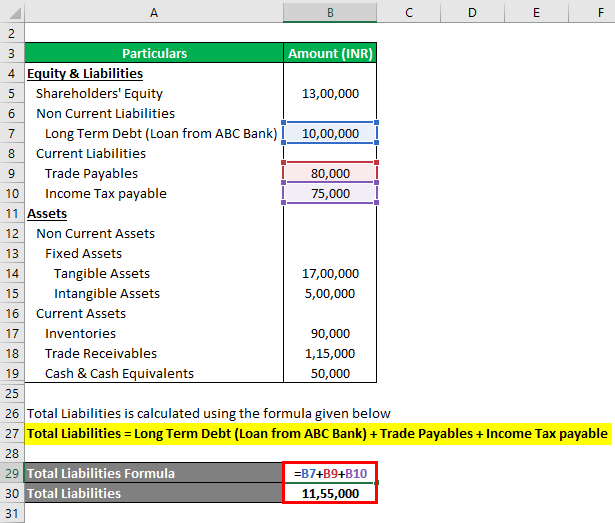

Net Asset Formula Examples With Excel Template And Calculator

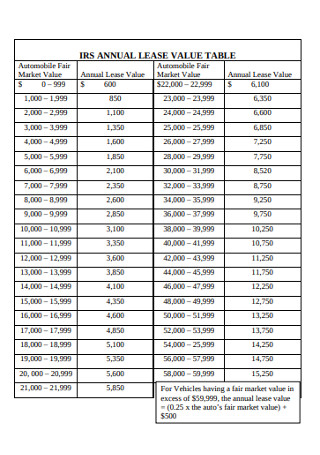

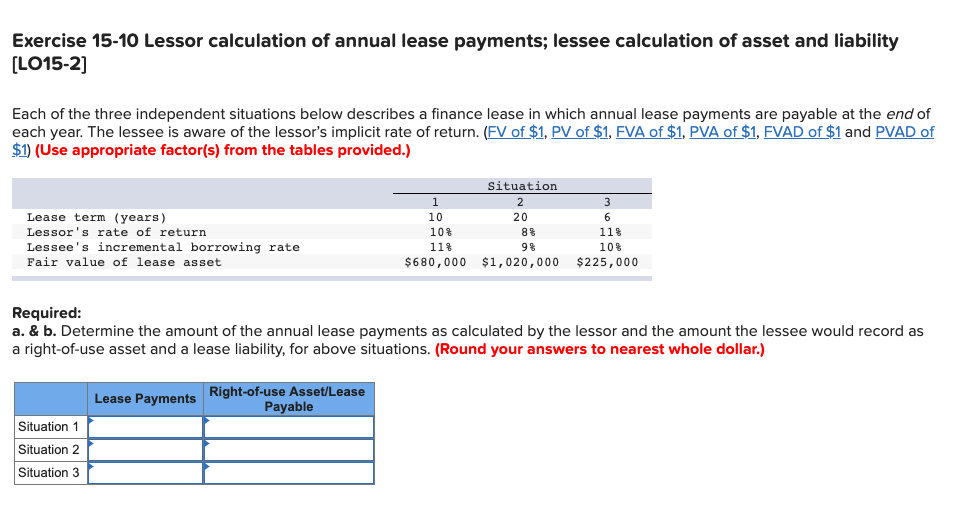

Vehicle Annual Lease Value from attached IRS table.

. ANNUAL LEASE VALUE METHOD For Autos Available 30 Days or More Fair market value of vehicle to be redetermined at the beginning of the fifth year and every four years thereafter. 2 For autos available for one or more but less than 30 days the. 1 Annual Lease Value from attached IRS.

A vehicles annual lease value is based on the fair market value of the. Depreciation Limits for Passenger Automobiles Acquired After September 27 2017 and Placed in Service During Calendar Year 2021 for which Additional First Year Depreciation Applies Tax. 1 Fair value is the purchase price of the automobile or the sticker price less 8 plus tax and license of a leased auto.

To use the lease value rule follow these steps. ANNUAL LEASE VALUE TABLE. You may value the use of that vehicle a fringe benefit to your employee by using the vehicles annual lease value.

Excess of 59999 the annual lease. 44 rows IRS Annual-Lease-Value Conversion Table The chart below is used to determine. For vehicles less than 30 days see below1 Fair market value of the vehicle to be redetermined at the beginning of.

Find the annual lease. The following table is to be used for valuing autos under the special rules An annual lease value determined under. Percentage of Year Covered.

Method I Lease value rule for vehicles available 30 days or more. IRS ANNUAL LEASE VALUE TABLE Automobile Fair Market Value Annual Lease Value Automobile Fair Market Value Annual Lease Value. The value of a vehicle that is made available to an employee for less than 30 days is determined using the daily lease value.

In response to the COVID-19 pandemic the IRS is allowing employers to switch from the vehicle lease valuation method to the cents-per-mile method 575 cents for 2020 56. Determine the value of the vehicle on the first day you made it available to any employee for personal use. For 2021 the business standard mileage rate is 56 cents per mile a 15 cent decrease from the 575 cents rate for 2020 and the rate when an automobile is used to obtain.

Of 365 days Personal Use Value Calculation Part II. Publication 15-B 2021 For automobiles with a FMN of more than 59999 the annual lease value equals 25 x the FMN of the automo- bile 500.

Compensation Benefits Is It All Taxable Income Ppt Download

Mountain Times Volume 48 Number 48 Nov 27 Dec 3 2019

27 Sample Management Research Report In Pdf

Nick S Ww2 Multiplayer Realism Mod Paradox Interactive Forums

Avis Budget Group Sec Filing

25 Sample Standard One Year Lease In Pdf Ms Word

Ashburton Courier December 09 2021

Full Article Chapter Six Asia

Teck S Investor And Analyst Day And Teck S Annual Sustainability Perf

Papers Past Parliamentary Papers Appendix To The Journals Of The House Of Representatives 1912 Session Ii Education Thirty Fifth Annual Report Of The

Slide Q5r3a3njias Jpg

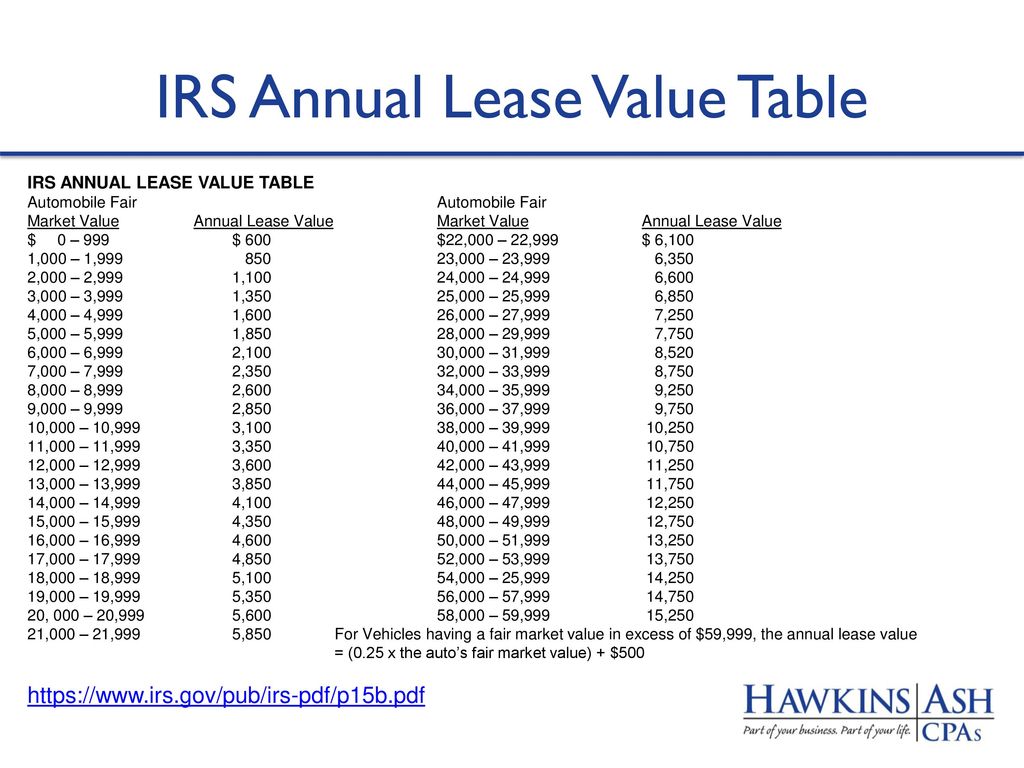

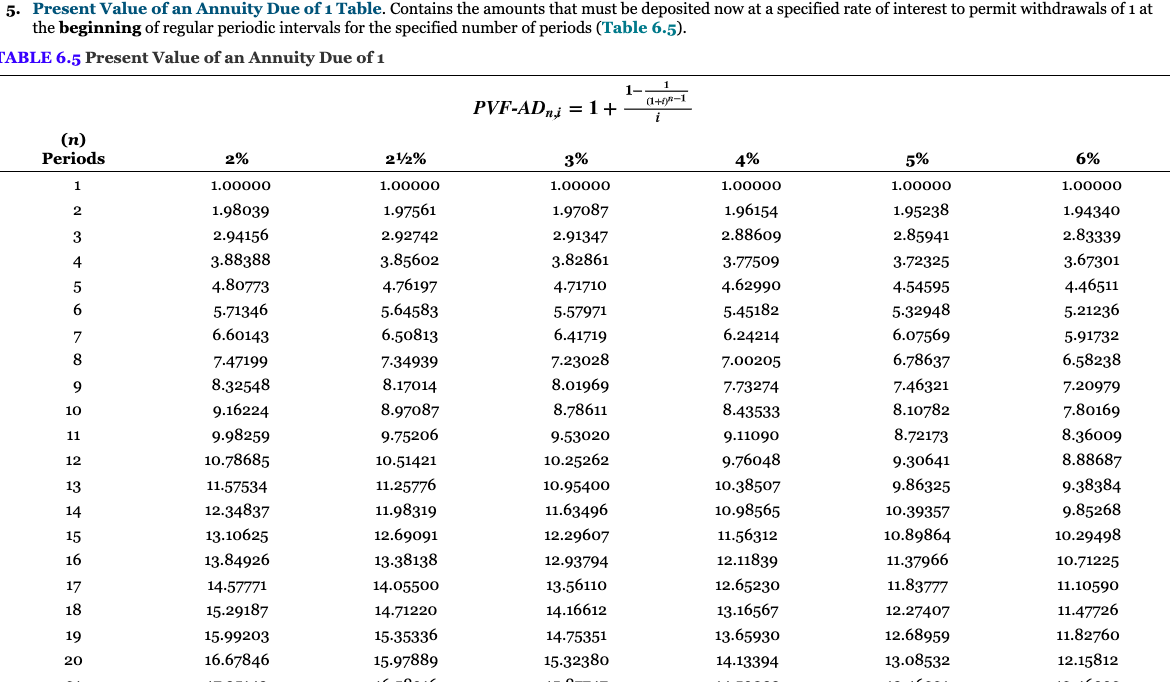

Solved Exercise 15 10 Lessor Calculation Of Annual Lease Chegg Com

Payroll Benefits And Year End Reminders For Ppt Download

2022 2026 Machinery Leasing Market Statistical Data

Solved Laura Leasing Company Signs An Agreement On January Chegg Com

Papers Past Parliamentary Papers Appendix To The Journals Of The House Of Representatives 1912 Session Ii Education Thirty Fifth Annual Report Of The

Bellingham City Council Public Comment Transcription Project January 11 2021 Through March 8 2021 Noisy Waters Northwest Noisy Waters Northwest